The holidays are the season for giving and spending inordinate amounts of time with friends and family. Unfortunately for many, tis also the season for overspending, financial hardship and a feeling of unpreparedness when the new year begins. Let’s face it, the holidays can get extremely expensive rather quickly. Especially if you haven’t taken the time to plan head.

From shopping for friends and family on your list to purchasing grocery items to make you big meal and entertain an onslaught of guests, to decorating and even heating your home, it isn’t difficult to find yourself and your wallet at odds. This is a huge problem.

Overspending over the holiday season can lead you to find yourself unprepared for the post holiday expenses that are sure to arise, becoming consumed with the post holiday blues. There are ways to avoid exhausting your wallet this holiday season, as well as preparing in advance for the coming new year’s initial expenses. After all, the new year is often viewed as a fresh start to celebrate, not to dread.

Thankfully, there are several ways to ensure that you don’t overspend and start the new year off on the right foot financially.

Think, prepaid cards. Yes, prepaid cards.

Why Prepaid Cards?

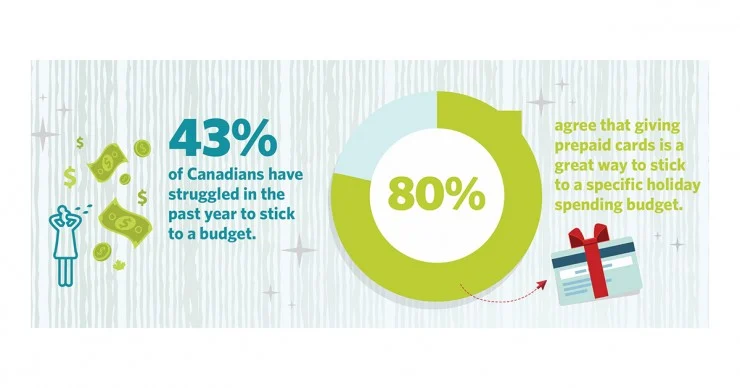

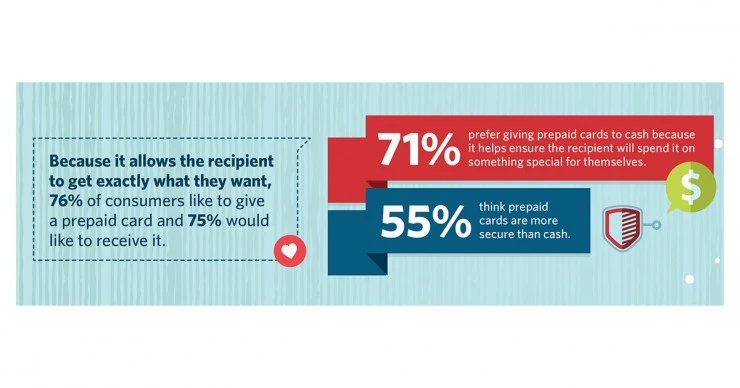

Prepaid cards are a fantastic way to keep your spending in check and start the new year off on the right financial foot. Not only do they offer a wide variety of the benefits that are associated with the traditional credit cards, such as being able to shop online, but they are also fantastic budgeting tools. A prepaid card comes loaded with a set amount of funds you pre-paid onto the card. Once those funds have been used, you know you have reached your limit, without going into debt, ensuring you stick to your budget.

You can Online Shop

Shopping online is a fantastic way to get all your holiday shopping completed but it can make it easier to overspend. Not when you use a prepaid card. Not only can you do your holiday shopping from the comfort of your own home, possibly while still wearing your pajamas, but once the funds are spent, you will know its time to stop.

Avoid Interest and Overdraft

Prepaid cards allow you to spend while the funds are there without having to worry about costly interest or overdraft protection. This allows you to stick to a solid budget, without the surprise of accruing additional charges once the season is over.

Protection

Certain prepaid cards that are issued by prepaid issuers and financial institutions comply with applicable regulations and laws when it comes to consumer protection and compliance. This means that it’s users can trust in protection from loss and fraud. Just make sure to check out the terms and conditions of the card you choose and register it properly.

No Credit Card? No Problem.

Prepaid cards are a fantastic way for those who don’t generally have credit, to do their shopping online. Inclusion for everyone, even those who would rather not open a credit card account.

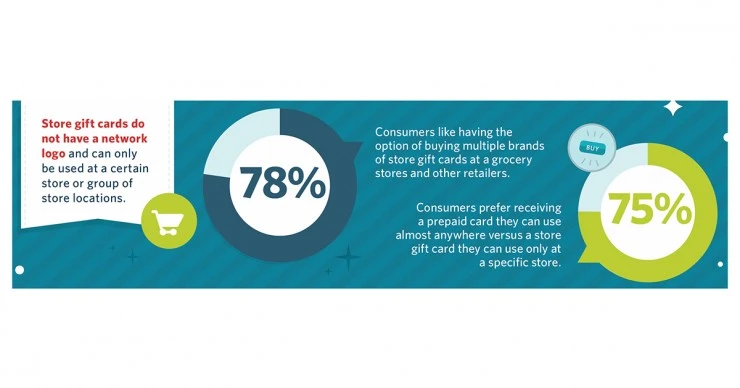

They Make the Perfect Gifts

Giving the hard to buy for person on your gift list this year the gift of a prepaid card, is a great way to ensure that they can get what they want most. This year you can give the gift of convenience.

Prepare for the New Year

Saving a prepaid card for after the holidays can help you prepare for unexpected post-holiday expenses that may arise. In fact, if you take any that you have received as gifts and stash them for January, you will be grateful when something arises after the expensive holiday season.

Using prepaid cards as budgeting tools is a fantastic way to ensure that you keep track of your holiday spending, save for vacations, prepare for the unexpected and even purchase groceries.

To learn more about the power of prepaid cards, visit ccpo.ca. Now is your chance to find out where and how to stick to your budget with a prepaid card.

Disclosure: This post has been brought to you by cppo, however all thoughts and opinions are honest and my own.

Elizabeth Lampman is a coffee-fuelled Mom of 2 girls and lives in Hamilton, Ontario. She enjoys travelling, developing easy recipes, crafting, taking on diy projects, travelling and saving money!

Elizabeth A Hughes-Callison

Tuesday 18th of December 2018

Elizabeth, I have enjoyed your article on not over-spending during the holidays. This is a topic that I talk a lot about to my peeps, in fact, I curated your blog post just today. I look forward to reading more content from you.